Trump’s protectionist overreach shouldn’t send Democrats back to neo-liberalism and free trade.

I’m guessing you know the basics of this story, because it’s gotten blanket coverage in the media: Trump announced wild and ridiculous tariffs, global markets crashed, and then he partially backed off, leading to a partial recovery. (If you want a more complete review, it’s in footnote [1].)

Of course Trump never admits a mistake, so the party line is that he meant to do this all along; the whole fiasco is a negotiating tactic straight out of The Art of the Deal. And the Trump-worshiping chorus immediately fell into line: “an absolutely brilliant move“, “brilliantly executed“.

But anybody with their eyes open saw this episode for what it was: a colossal blunder that is far from fixed even now. Jay Kuo summarized: “Trump screwed up bigly on tariffs, and he knows it.” [more critiques, including mine, in footnote 3]

But even more interesting, I think, were articles defending Trump’s tariffs sort of. Typically the headlines were Trump-friendly, like “There’s a Method to Trump’s Tariff Madness” and “Stop Freaking Out, Trump’s Tariffs Can Still Work” in the NYT, or even “Tariffs Can Actually Work, If Only Trump Understood How” in the Financial Times. But the content of the articles was less favorable, more along the lines of: Higher tariffs might work, but not like this.

The best such article I found was Ross Douthat’s interview with Oren Cass (author of the “Stop Freaking Out” article). I’m not usually a big Ross Douthat fan, but here he asked the right questions and got significant nuance out of Cass.

Cass begins with a critique of the globalization era, arguing that while GDP has increased just as economic theory says it should, GDP doesn’t tell the full story.

when we’re looking at the actual well-being and flourishing of the typical working family and their ability to achieve middle-class security, we’ve seen real decay. And I think that explains why somebody like Donald Trump has become as successful politically as he has.

It’s striking how closely this echoes what Pete Buttigieg told Jon Stewart:

The bottom line is: If the economy and the government were working the way it should for most Americans, a guy like Donald Trump and a movement like Trumpism would not have been possible.

Cass notes the bifurcation between types of working people.

When you’re looking at these household income numbers, it’s important to notice how much they rely upon the household having two earners and how much more reliant they find themselves on government programs than in the past. … I think we have a problem, particularly for the right of center that sold this idea of a rising-tide-lifts-all-ships model and we all march forward together into the brave new future. What people are seeing instead is that some people got to march ahead into the brave new future and a lot of folks did not. … Research at very optimistic groups like the American Enterprise Institute shows that young men ages 25 to 29 are earning the same or less than they would’ve been 50 years ago. And I think it’s hard to sell that as a successful economy or one that’s likely to produce a flourishing society.

The conversation shifts to trade, and the corresponding loss of manufacturing jobs. Douthat asks the right question: What’s so special about manufacturing jobs? If the pay is the same, why should we care whether people work in a Ford plant or in a bank?

Cass has a set of answers:

- Manufacturing jobs tend to be scattered throughout the country, while service jobs cluster around big financial centers. So loss of manufacturing has impoverished large sections of the country, particularly small towns in otherwise rural areas.

- An economy with both manufacturing and service jobs has employment opportunities for a broader talent pool than a pure service economy has.

- Our country is more secure militarily if we manufacture the products we need to defend ourselves (rather than depend on, say, Taiwan for our advanced computer chips; depending on a potential enemy like China is even worse). But it’s hard to preserve those industries in isolation, rather than as part of a diverse and robust manufacturing sector. “If you actually want to be an industrial power, you need the actual materials themselves. You need to know how to make the tools that make the materials, things like machine tooling, the actual excellence in engineering that’s going to lead to efficient production.”

His prescription is more nuanced than either Trump’s or the free traders’.

the equilibrium you’re headed toward is not one where we shut off trade. It’s one in which there’s more friction in trade, so that there’s a preference for domestic manufacturing

So he favors the across-the-board 10% tariff. That’s not high enough to bring back low-productivity manufacturing jobs, which is probably not a worthy goal anyway. If a t-shirt made in Indonesia now imports wholesale for $2.20 rather than $2, you’re not going to start making them in Mississippi. And because trade continues, that 10% tariff does raise revenue, but not enough to replace the income tax. It’s friction, not a locked door.

Higher country-specific tariffs might be used as negotiating tools against countries that have truly unfair trading practices. But the mere existence of a trade deficit doesn’t imply unfair practices.

And finally, he sees China as a special case. Because it is our main rival for global power, we can’t let ourselves depend on them for anything really important. So higher tariffs on Chinese imports make sense, but in concert with our allies, rather than fighting a one-on-one trade war.

we want to have a large, U.S.-centered economic and security alliance. We want to have very low tariffs within that group, obviously Mexico and Canada, obviously other core allies.

But unlike in the past, we have some demands. We want to see balanced trade within that group so that we reshore and reindustrialize significantly in this country, and we want to see a common commitment among all these countries to decoupling from China.

That’s the substance of his proposals, but he also makes an important point about how they would be implemented. The purpose of tariffs is to change long-term behavior, not to create short-term shocks to the system that might drive the world economy into recession or worse. It’s more important that corporations, governments, and other key decision-makers know what tariffs will be two and three years down the line than that significant change happen right away.

That means:

- gradually phasing in higher tariffs over time

- justifying those tariffs as part of a coherent strategy

- building a consensus around that strategy — in particular getting them passed into law by Congress — so that decision-makers will know they won’t change every time the political winds shift

What we have instead — sudden tariff shocks based on the whims of one man, who might change his mind tomorrow — is all cost and little benefit.

Cass represents American Compass, a conservative think tank. But the substance of his proposals is not far away from the ideas of the Democratic left. To me, this suggests the possibility of bipartisan consensus on policy — if we could get Trump out of the way.

[1] A somewhat longer version of the story: Trump announced massive tariffs on April 2. World stock markets [2, a footnote to a footnote] spent a week crashing (with a temporary rally on April 8 when it was rumored he would back off), and then on April 9 he announced he would delay enforcing most of the tariffs for 90 days to allow the targeted countries to negotiate. However,

Trump said he would raise the tariff on Chinese imports to 125% from the 104% level that took effect at midnight, further escalating a high-stakes confrontation between the world’s two largest economies. The two countries have traded tit-for-tat tariff hikes repeatedly over the past week.

Trump’s reversal on the country-specific tariffs is not absolute. A 10% blanket duty on almost all U.S. imports will remain in effect, the White House said. The announcement also does not appear to affect duties on autos, steel and aluminum that are already in place.

The 90-day freeze also does not apply to duties paid by Canada and Mexico, because their goods are still subject to 25% fentanyl-related tariffs if they do not comply with the U.S.-Mexico-Canada trade agreement’s rules of origin. Those duties remain in place for the moment, with an indefinite exemption for USMCA-compliant goods.

Then he announced a change that seemed designed to benefit Apple and its users.

On Friday night, the US president handed Apple a major victory, exempting many popular consumer electronics. That includes iPhones, iPads, Macs, Apple Watches and AirTags. Another win: The 10% tariff on goods imported from other countries has been dropped for those products.

The partial reversal on tariffs led to a partial stock-market recovery: The S&P 500 was at 5670 when the tariffs were announced, fell to just under 5000 at its low on Tuesday, and bounced back to 5363 by the end of the week, a net fall of about 5.4%

[2] If you want to get into the weeds, apparently the crash in the bond market had more influence on Trump. The Atlantic’s Rogé Karma explains why this was so unnerving:

Yesterday morning, the U.S. economy appeared to be on the verge of catastrophe. The stock market had already shrunk by trillions of dollars in just a few days. Usually, when the stock market falls, investors flock to the safest of all safe assets, U.S. Treasury bonds. This in turn causes interest rates to fall. (When more people want to buy your debt, you don’t have to offer as high a return.) But that didn’t happen this time. Instead, investors started pulling their money out of Treasury bonds en masse, causing interest rates to spike in just a few hours.

Suddenly the entire global financial system appeared to be at risk. If U.S. Treasuries were no longer considered safe—perhaps because the country that issues them had recently shown its willingness to tank its own economy in pursuit of incomprehensible objectives—then no other asset could be considered safe either. The next step might be a rush to liquidate assets, the equivalent of a bank run on the entire global financial system.

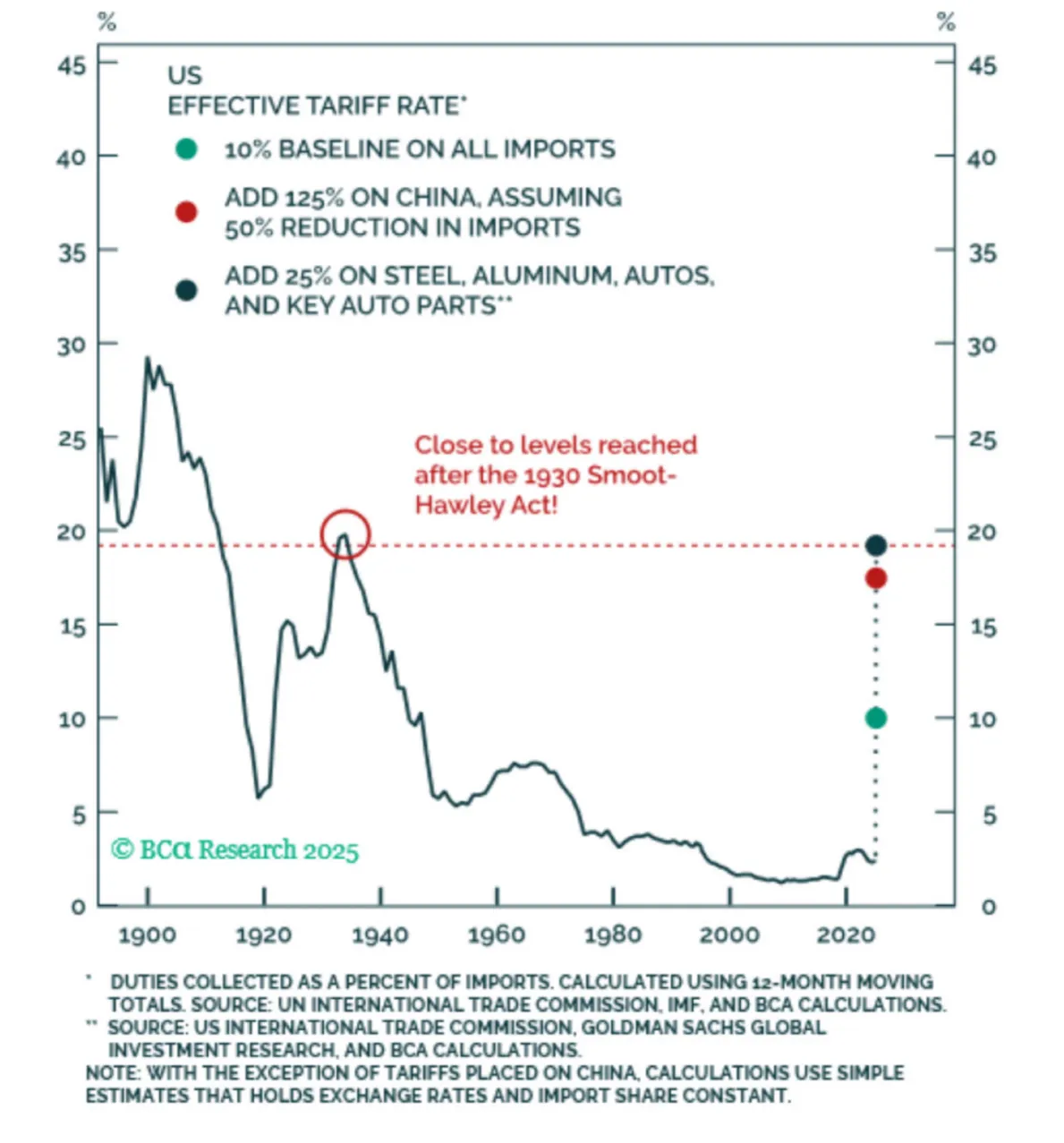

[3] Jay Kuo also provided this chart showing just how high the average tariffs are, even after Wednesday’s walk-back.

Paul Krugman posted his assessment yesterday:

I wanted to put up a quick response to yesterday’s sudden move to exempt electronics. What you need to know is that it does not represent a move toward sanity. On the contrary, the Trump tariffs just got even worse.

Main reason: The current tariff breakdown discourages US manufacturing.

Import Chinese battery: 145% tariff

Import Chinese battery inside Chinese laptop: 20% tariff

Import Chinese battery inside Vietnamese laptop: 0% tariff

I’m putting my own critique of Trump’s tariffs in this footnote, because I’ve posted it before and don’t want to get repetitive. Basically, Trump touts his tariffs as accomplishing three contradictory purposes:

- raising revenue that can replace other taxes, especially the income tax

- creating jobs by bringing manufacturing and manufacturing supply chains back to America

- motivating negotiations that will lower other countries’ barriers against American exports

To provide a revenue stream that can replace other taxes, the tariffs have to last for years and the US has to continue importing tariffed products. But to the extent that manufactured products and their supply chains move to the US, imports of tariffed products will fall, lowering revenue from the tariff.

In order to move manufacturing and its supply chains back to the US, the tariffs again have to last for years. Corporations will only move their factories if they expect the tariffs to remain in place into the distant future. But if the tariffs are a bargaining chip to be negotiated away, they won’t last. To the extent that corporations expect trade negotiations to succeed, they’ll leave their factories overseas.

Worse, the on-again/off-again nature of Trump’s tariffs, at least so far, discourages businesses from making plans that rely on those tariffs. So even if they last far into the future, they may not bring jobs back to the US. In many ways, the erratic policy we have seen the worst of all worlds.

Comments

wasn’t this manner of multinational economic alliance the basis of the Pan Pacific Partnership that Hillary was forced to reject?

Weapons manufacturing is a good microcosm of the rot in the neoliberal political economy. It’s a vital interest for the empire so it gets trillions of dollars thrown at it. Despite this, America’s war industry is still so decayed that Tom Goffus, NATO’s Assistant Secretary General for Operations, admitted that Russia now produces 4 times as many key munitions as all of NATO:

“We are woefully under-invested in our transatlantic defense industrial base to produce the capabilities we need at pace and at scale. Russia, with an economy 5% the size of NATO, produces in three months many critical munitions that it takes 32 allies an entire year to produce. I know I’m not making friends amongst the industry at this point, but something is very wrong here, and we must fix it.”

Goffus expanded on that last lesson.

The defense industrial base has “not been this important in a long time,” he explained, adding that the U.S. has to step up its capacity to produce weapons.

Lithuania wants “to buy AMRAAMS for their NASAMS,” he stated. “Five-year wait. I talked to the Bulgarian CHOD [Chief of Defense]. They want to buy Javelins for their Strykers. Seven-year wait. I talked to some of the big allies who want to buy Patriots. 10-year wait. That needs to get fixed.”

Lots to unpack there. First of all, GDP is fake. Never forget this. Beyond that, expanding material production is never going to be as profitable as rent seeking, financial scams, and price gouging, so it won’t happen. Why make the massive capital investments to build a munitions plant when you could just increase the price on the tiny amount of munitions you do make, then use the money for stock buybacks? After all, the war in Ukraine will end one day, but you’ll still be on the hook for the factory’s costs. National interests will always be second to short-term profits. This logic applies to every other manufacturing sector, so it’s no surprise that no one has been able to stop manufacturing’s decay since the neoliberal turn.

Actually bringing back manufacturing would either require material production to be more profitable than financial products, or require the state to step in and do the production itself without concerns for profit. Making either of those happen would require so much more than tariffs. They would need a complete remaking of America’s political economy that makes capital’s profits subservient to the state’s interests. The senile morons running America have shown no ability to even recognize this problem, let alone solve it.

On a related note, China has 232 times the shipbuilding capacity of America. Any blood-gargling lunatic pushing for a confrontation with China just wants you to go out like Imperial Japan in the 40s.

“That’s the substance of his proposals, but he also makes an important point about how they would be implemented. The purpose of tariffs is to change long-term behavior, not to create short-term shocks to the system that might drive the world economy into recession or worse. It’s more important that corporations, governments, and other key decision-makers know what tariffs will be two and three years down the line than that significant change happen right away.

That means:

What we have instead — sudden tariff shocks based on the whims of one man, who might change his mind tomorrow — is all cost and little benefit.”

Well, right, if your goal is actually to make things better, then all of the above would make sense. If your goal is to manipulate the stock market so your cronies can get rich, while proving to your followers how tough you are, then you you implement tariffs like this.

The way Trump is using tariffs to generate chaos, one might think he doesn’t care what tariffs exist in the end, as long as he gets deals out of it. He muses about replacing the income tax, but everything he does is written by some advisor, and I don’t see any names popping up or concrete plans in support of that.

One question is if the world would be incentivized to sell off dollar holdings and transition to a global trade that significantly excludes the U.S. Ordinarily that would not happen, because the fraction of tariffs paid by exporters would generate foreign dollar demand and raise the value. But economists say that’s a small fraction, and the chaotic execution so far appears to be reducing foreign investment.

USD is at a nearly 2 year low right now and dropping (3% in 5 days), so while a weaker dollar might boost exports, maybe it’s not the time to be talking about tariffs as a sustainable revenue source. Maybe never, actually.

A one-two sucker punch from the NYT’s resident self-flagilst monk and a cloistered, conservative 1%er from Williams making the media rounds peddling his low-key, very restrained delivery as revealing the gravitas Serious™ people expect and should be accepted as a priori truth. I’m surprised Douthat didn’t title his column, “Why My Catholic Guilt and Insatiable Need to Atone Tells Me The Pain of Tariffs Is Good for Everyone”. Why, Cass even turned up for a chat on Pod Save America, where he refused to allow himself to pinned down on the facts that his vision of how to layer tariffs into the international trading system that’s been meticulously built over the past 40 years will never come to pass, and that tariffs are a domestic tax that is highly regressive and will never remotely be a substitute for the revenue generated by an income tax.

Cass uses a standard rhetorical technique of identifying negative consequences of change, and then implying that returning to the way things were before those changes will solve the problem(s). This is absurd. Moreover, he fails to identify the primary reasons middle-class economics has been hollowed out: the decoupling of productivity gains from labor wage growth that started with Reagan, the destruction of labor unions, and the massive tax cuts for the wealthy and corporations. In addition, the greatest pressure on America’s middle class is the cost of housing, something the rent-seeking economic elite are going to increasing pursue and that tariffs will only make worse.

A thorough refutations of Cass’ drivel and tariffs in general, from both a historical perspective as well as forward-looking economic one, is beyond a simple reply or two, but there some fundamental points to be made.

First, the best path to economic growth for all parties involved is free trade. To be sure, nationalistic political considerations argue there are circumstances that should acknowledge potential consequences of international free trade, such as maintaining (even if it requires government subsidies to do so) a viable steel industry in case of future defense needs, but these always also acknowledge that restricting free trade for such objectives is less economically efficient, and benefits no one economically.

Second, friction for friction’s sake is nonsense, and accomplishes nothing except making consumer goods more expensive that they would otherwise be. The last thing middle-class America needs is to increase their expenses of living. And, the method of creating such friction is effectively a national sales tax, but without the honesty of calling it that. And, like all sales taxes, it’s highly regressive, and will have the greatest negative impact on those least able to bear it.

Third, basic macroeconomics tells us that as prices rises, demand will decrease. So, even if somehow tariffs accomplished the return of domestic goods to American economy, fewer of them will be sold, and the shrinking pie from this is what will be available. Decreased demand generally leads to recession, and historically, this has been the most pronounced historical effect of tariffs.

Finally, and this is the most important point: as the Treasury Secretary has stated, the future of manufacturing is robots and AI. The only thing more manufacturing in the US is going to do is make a handful of owners even richer. Even if the complex international supply chains could somehow be eliminated and American colonialism could provide raw materials at bargain prices, American labor will not be the beneficiary. Those days, like the American family farm, are gone, and they ain’t coming back.

If the concern is the economic well-being of America’s middle class, (and it’s not), what is needed is to admit we are moving beyond a period where there is enough demand for individual physical labor to fuel a national economy without the intervention of the government to adjust where the economic rewards of that economy go. Our overall economy produces easily enough economic reward to sustain everyone comfortably. But because we don’t pool that output and share it, but rather allow it to be horded by a markedly small ownership class that controls absurd amounts of wealth they will never be able to spend while a majority of people are barely living at subsistence levels, our country has hollowed out the kind of strong middle class that a strong consumer-demand economy requires to power it.

We need to admit that we are entering a time when relatively few people are needed to make things; when robots and AI can do the daily drudge work of rolling the stone up the hill and people can be freed from having to do that and go on to doing whatever may inspire them. In order to finance this future, our government must tax the absurd excessive profits the ownership plutocracy collects from this system and redistribute them to everyone in the form of a guaranteed annual income, sufficient to comfortable cover each person’s daily living needs.

If someone want’s more, more will still available, at least for some. And the ownership class will still be able to buy their Monets and rocketships. But we will achieve what the current economic system does not, and what tariffs will certainly only make worse: the ability for every American to live a life that’s secure from fundamental want and offers a future of growth built on a platform of that security.

The way we fund political campaigns is part of why middle-class economics has been hollowed out. Big donations from the wealthy means that candidates are influenced too much by the opinions of the wealthy.

We allowed companies to relocate overseas to take advantage of cheap labor. Those moves were partially financed by favorable tax breaks and workers were left to struggle while plutocrats thrived. We are now faced with the result of those disastrous decisions.

The result? If you take away people’s hope for a better life, and they realize that there is even less hope for a better future for their children, they will realize they have nothing left to lose. The immediate result is trump. When that fails, and it will, the next step will be, as Louis XIV said, “Apres moi le deluge”.

Here’s a critique of Oren Cass from the right, back from before the current stock-market-manipulating nonsense going on today, when Cass was softening the ground for accepting tariffs should Trump win the 2024 election.

“Economists Understand Tariffs Just Fine. Oren Cass Does Not”

https://www.nationalreview.com/corner/economists-understand-tariffs-just-fine-oren-cass-does-not/

It’s interesting to note that this critique also calls out Cass for his rhetorical slights-of-hand, in addition to correcting his economics and the fallacies in policy prescriptions they produce.

The primary takeaway is, again, that tariffs are a tax, and need to be evaluated as a tax. For neo-liberal conservatives, that they are a tax is enough right there to oppose them. For the left, that they are a regressive tax imposed on those least able to pay, and done so in order to further relieve those at the very top of the economic pyramid from contributing to the cost of running a civilized society, is a strong reason to oppose them.

For those in the center, who simply desire solutions to address the frustrations and angst of modern American populism born of economic globalization, it’s important to understand that tariffs will not serve as some sort of time machine that takes America back to its (relatively short) period of industrial dominance supplying good wages to a (at best) moderately educated workforce rebuilding the rest of the world destroyed by war.

The problem to be fixed is that the economic output of America flows disproportionately to the very select few at the top, similar to the Gilded Age that McKinley served and TR opposed. Until America forthrightly acknowledges this and agrees that that this is at the root of what ails our nation, ‘solutions’ such a tariffs will be trotted out, the patient will be bled more because he fails to get better, and the economic pressures that drive populism will only grow.

Trackbacks

[…] week’s featured posts are “What to Learn (and not Learn) from Trump’s Tariff Blunders” and “Reclaiming the Spirit of […]

[…] What to Learn (and not Learn) from Trump’s Tariff Blunders […]