Plutocracy survives by pitting working people against each other. Ginning up outrage against the Americans who are getting some of their student debt cancelled is just a new verse in an old song.

Back in 2012, when presidential candidate Mitt Romney was taking heat for all the jobs he destroyed on his way to wealth, he accused his critics of practicing “the bitter politics of envy” and “class warfare“. Mitt didn’t think we should resent him just because he’s richer than the rest of us, and we also shouldn’t resent any of the hard-hearted things he did to reach that exalted position.

The year before, though, we heard a very different message about envy from another conservative presidential wannabe, Wisconsin Governor Scott Walker, who at the time was trying to kill off the state employee unions. Walker’s ally, the Club for Growth, ran ads telling Wisconsinites working in the private sector who they should really resent for the hard times that had followed the real-estate bubble of 2008: not billionaires like the ones who fund the Club for Growth, but those same state employees that Walker was trying to shaft.

All across Wisconsin, people are making sacrifices to keep their jobs. Frozen wages. Pay cuts. And paying more for health care. But state workers haven’t had to sacrifice. … It’s not fair. … It’s time state employees paid their fair share, just like the rest of us.

Is that bitter or what? The ads barely bothered to explain what benefit ordinary Wisconsinites would get from sticking it to the clerks at the DMV, other than the satisfaction of seeing those uppity state workers finally get theirs.

But strangely, Mitt’s anti-envy crusade never mentioned those ads. Because the point was never to remove envy and bitterness from politics; it was to make sure people’s resentment was directed down or sideways rather than up.

So if life seems unfair to you, don’t look at the guy on top, who is raking off vast sums of money for doing something of nebulous value, often with government help. Look instead at, say, the teachers and nurses who work for your state. If their union is making sure they still get a fair day’s pay for a day of hard work, while somebody like Mitt Romney has laid you off — well, screw those teachers and nurses!

Better yet, screw the poor family who got an extra $50 of public assistance because Jenny didn’t report her babysitting income. Such dishonesty! Ignore the corporation that got a big tax cut to create jobs, and then conveniently forgot to create jobs. Ignore the guy who claims to be a billionaire, but keeps using the bankruptcy laws to stiff his creditors. Did you know there’s a guy who buys lobster with food stamps? (Or at least there was, back in 2013. He still comes up from time to time.) That’s what’s wrong with America!

You know who else is destroying America? People who are so desperate that they risk their lives to come here so they can clean our toilets for less than minimum wage. Who do they think they are? We have laws, you know.

This is how plutocracy survives: If you’re unhappy, focus your resentment on other people like you, or maybe people worse off than you. But don’t look up with anything in your heart other than awe and gratitude. Never look up in resentment.

The current example of this trick is the attempt to raise anger about Biden’s student-debt-relief program, which was announced Wednesday.

Before we get into the divisive rhetoric, let’s quickly review what Biden’s program does: If you have student loans and you don’t make too much money, you can get part of your debt forgiven. The amount of forgiveness is capped at $20K if you received a need-based Pell Grant, and at $10K if you didn’t. (Two-thirds of Pell Grant recipients come from families with less than $30K of annual household income.) And “make too much money” means $125K per year for an individual or $250K for a household. The Biden administration estimates that the bulk of the benefit will go to people making considerably less than the upper limit.

In addition, Biden’s executive order changes the rules around payment rates: Required payments are capped at 5% of discretionary income (down from 10%), and the definition of “discretionary” has changed to lower the payments further.

NYT columnist Jamelle Bouie points out that you don’t have to have gone to college to benefit:

If you want to haul freight for a living, you’ll need a commercial driver’s license, which means you’ll need training, which means you’ll need school. This schooling can cost thousands of dollars, and students can pay their tuition with federal student loans. So, too, can people who need training to work as medical technicians or home care workers or physical therapists or restaurant workers, among many other trades and professions.

Millions of people with blue-collar jobs owe thousands of dollars in federal student loans, and they may not have the income needed to pay them off. Biden’s plan helps them as much or more than a graduate of a four-year college with debt on the ledger. It also helps the millions of Americans who took out loans, attended college, but for one reason or another could not complete their degrees and are in the worst of all financial worlds as a result.

One of the examples in Biden’s announcement calls attention to this fact:

A typical single construction worker (making $38,000 a year) with a construction management credential would pay only $31 a month, compared to the $147 they pay now under the most recent income-driven repayment plan, for annual savings of nearly $1,400.

In short: Biden has done a pretty good job of aiming this program at middle-and-lower-class people who tried to better themselves through education and training, but didn’t strike it rich.

But if you listened to the Republican response, or the drum-beat on Fox News, you wouldn’t grasp any of that. Conservatives are trying to turn this into a culture-war issue, with taxes from salt-of-the-Earth non-college folks paying for a benefit that goes only to privileged (but lazy) intellectual snobs.

Senate Minority Leader Mitch McConnell (net worth $35 million, and I’m not sure if that counts his wife’s $30 million) blasted the proposal:

Democrats’ student loan socialism is a slap in the face to working Americans who sacrificed to pay their debt or made different career choices to avoid debt. A wildly unfair redistribution of wealth toward higher-earning people.

Marjorie Taylor Greene (whose construction company had a $183K loan forgiven under the Paycheck Protection Program) also drew a culture-war battle line:

Taxpayers all over the country, taxpayers that never took out a student loan, taxpayers that pay their bills and maybe even never went to college, just hardworking people, they shouldn’t have to pay off the great big student loan debt for some college student that piled up massive debt going to some Ivy League school

Ted Cruz (an Ivy-Leaguer who was a Princeton undergrad before going to Harvard Law School and is married to a Goldman Sachs banker) sharpened the image of who you should resent:

If you are that slacker barista who wasted seven years in college studying completely useless things, now has loans and can’t get a job, Joe Biden just gave you 20 grand

Or maybe the reason you’re in debt over your head is that you “wasted” four years training to teach in the Texas public schools, while Ted spends over $40K per child per year on his kids’ private school.

But we don’t even need to go there, because barista is a job. That “slacker” woman does real work that keeps her on her feet all day, and Ted has just slapped her in the face.

That barista insult also points to another fault line Republicans are trying to exploit: generational resentment.

A lot of people my age and older are making an I-suffered-so-I-want-everybody-to-suffer argument. (An aside to people who claim to reach their conservatism by way of Christianity: Can you imagine a less Christ-like position?)

Supposedly, forgiving any student debt at all is an “insult” to the people who have paid their debt in full, or paid for college without loans (as many people my age did). Similarly, emancipation was an insult to all the enslaved people who escaped to Canada without Lincoln’s help. The Covid vaccines are an insult to all the people who died of Covid before they were available. And so on. It’s not fair.

The most bizarre aspect of this debate is that there actually is a generational-justice issue here, but it points in the opposite direction: People (like me) who got our higher educations in the 1970s and 1980s received our government subsidy up front. That’s why we didn’t pile up debt.

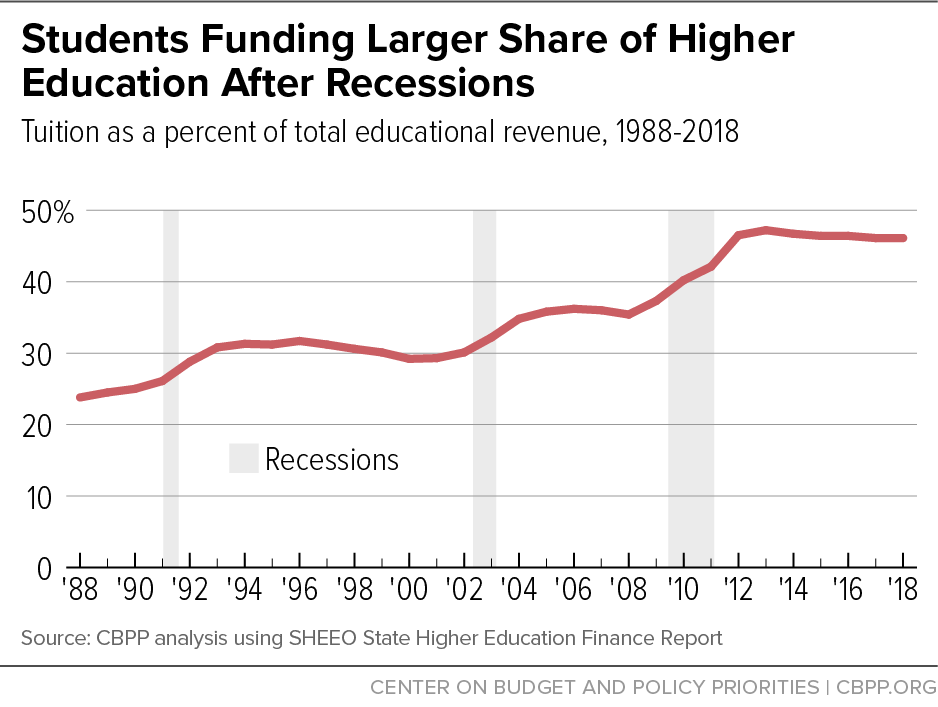

That happened in two ways. First, the grant money available from the federal government covered a much bigger percentage of student expenses.

But even that graph doesn’t really capture what’s been happening. One reason the orange line rises so quickly is that state governments were cutting back on the money they spent on their university systems, which then had to cover their costs by raising tuition. And as tuition rose at top state universities like Berkeley or Michigan, private colleges and universities faced less competition, and so could raise their tuition as well.

You can see the pattern in the graph below: Every time a recession threw the states’ budgets into crisis, they cut back on higher education. But when the economy improved, the cuts were never restored. As a result, the portion of college costs that students paid through tuition nearly doubled, from about a fourth to almost half.

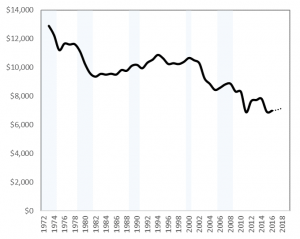

Here’s how that pattern played out in Wisconsin. The graph below charts the state appropriation for the University of Wisconsin system per full-time-student-equivalent per year, adjusted for inflation.

That, in a nutshell, is why Millennials are carrying so much student debt: State and federal governments put much less money into their educations than those governments had put into, for example, mine. So Millennials had to borrow to cover the difference.

But let’s add one more piece to the puzzle: the loss of other options.

At the same time higher education was getting more expensive, high-paying jobs for people without some post-high-school degree or credential were going away. And like the rise in tuition, this trend was the result of government policies: Two key parts of the Reagan revolution (which Bill Clinton mostly either let stand or actively continued) were union-busting and globalization, which sent entire manufacturing industries overseas and forced huge wage-and-benefit concessions from the workers who still had jobs.

Fifty years ago, a union job on the assembly line at GM or a truck-driving job under a Teamster contract was a plausible path to the American dream. On that one income, you could buy a house, raise children, and even send those children to (government subsidized) college if they were so inclined.

Or you could work a union job for a year or two while you lived with your parents, and save up enough money to put yourself through college.

No more.

So in these last few decades, young people born without wealth have faced an increasingly grim choice: accept that they are permanent members of an underclass that will always have to struggle financially — like the baristas Ted Cruz despises so much — or gamble on their future success by taking on enormous debts. (I anticipate the objection that there’s a third choice: start your own business. But if you don’t have parents wealthy or connected enough to get you started — like, say, Bill Gates or Jeff Bezos — that path also typically involves heavy borrowing.)

And who put them in that unfortunate position? The US government and the voters who supported its policies.

So when I look at the whole picture, I think letting some of those debtors partially off the hook is the least we can do.

And if that outcome leaves you with boiling resentment that still needs a target, I have a suggestion on which direction you should look.

Comments

Excellent explanation!

This post violates the Law of Limited Good: There’s only so much Good in the world, and if you get some then there’s less for me.

So Doug, what are practical ways to talk to conservatives about this without implying to them that hard work shouldn’t be rewarded? I have a conservative friend who is livid because he paid for his son’s tuition (who recently graduated).

The only way I can think of is to convince him that it was immoral for him to have had to pay that money in the first place. In that respect the government is now fixing an immoral payment system, which at least helps later borrowers. But convincing him of that would make him feel like a loser – an idiot who was fooled into thinking that paying that tuition was ok and not exploitative.

And this is the broader problem. Conservatives feel like suckers already paying for someone lease (using conservative logic), but they would feel like suckers in a different way if they bought into liberal logic. So it seems like they’re kinda screwed either way.

As a follow on to this, do you think that conservatives – all else being equal – are more likely to see the world as moral and just compared to liberals? This is the only way the loan forgiveness resentment would make sense. Conservatives see loan forgiveness as letting some people (but not others) off the hook for violating the commitments they made, which is immoral. Liberals see these payment commitments made by people as borderline unjust to begin with and therefore not subject to the normal rules of “you should be punished for committing to do something and then reneging on that commitment.”

I found this account of the origins of the Republican position on college loans and student debt troubling but informative: https://theintercept.com/2022/08/25/student-loans-debt-reagan/

President Biden’s loan forgiveness is bad public policy. Increases in financial aid enable colleges and universities to raise there tuitions knowing that loan subsidies from the Federal government will be guaranteed.

An average tuition increase associated with expansion of student loans is as much as 60 cents per dollar.

Salaries rise; bureaucracies expand!

The cost of a higher education will continue to escape the lower to middle classes ability to afford it.

So, if we got rid of student loans the Universities would lower their tuition to 1972 prices? Given that income for 90% of taxpayers has been flat since 1972.

Off topic: The “primal fault” everyone ignores with “The Trolley Problem” (I can’t believe people don’t realize they’re meant as jokes) is that the person making the decision isn’t under any threat, and bears no consequences for the outcome.

I’d like to echo that this is an excellent essay. It’s interesting that the manipulation of envy is the encouragement of what is called the “far enemy” of “Mudita” (translated often as empathetic or sympathetic joy — feeling joy at the good fortune of others) in Buddhist psychology. Mudita is one of four qualities (wishing others well (Metta), compassion (Karuna), and equanimity (Upekkhā) being its companions) that one cultivates. It is a sad and unsettling commentary when a person and/or party knowingly manipulates unhealthy qualities in themselves and others.

I’ve been saying that the reduction in university funding has led to having to take out more loans since the problem became apparent. It is fantastic that you used Wisconsin as an example. But there is more. Both Wisconsin and Michigan signed laws pledging 2/3 funding for education k-12, in Wisconsin the legislature has never lived up to that law. The University System has had an imposed tuition freeze for in State students for 12 years now which has caused at least the Madison campus to recruit students from out of state because they can charge them more. But even with tuition capped other expenses are rising and still pricing State students out.

Trackbacks

[…] This week’s featured post is “The Return of the Bitter Politics of Envy“. […]

[…] https://weeklysift.com/2022/08/29/the-return-of-the-bitter-politics-of-envy/ The Return of the Bitter Politics of Envy […]