Sure, it doesn’t make sense, but no form of money does. The more serious problem is that it’s an environmental disaster.

The value of the digital currency Bitcoin, which has skyrocketed since its introduction in 2009, fell 30% in one day on Wednesday. Should that worry anybody?

The mystery of money. I’ve barely said a word about Bitcoin and its rival cryptocurrencies on this blog, mostly because I know I don’t completely understand them. In some sense, though, that’s neither their fault nor mine. Money in general is mysterious: Dollars only have value because we all think they do. If everyone else in the world decided your dollars were worthless, you’d have a tough time convincing them otherwise.

The reasons dollars should continue to have value are a bit circular: All over the world, people owe dollars, so they’re going to have to obtain them to pay their debts. Also, the US government wants you to pay your taxes in dollars, so you’re going to need a few at some point. (Though, if you lived entirely by barter or by trading some untraceable currency like Bitcoin, what would the government tax?)

The Federal Reserve can create dollars at will just by entering a credit on its balance sheet, and that’s hard to square with the idea of intrinsic value. After all, farmers can’t increase the grain supply by manipulating their accounting. If GM wants to produce more cars, it has to buy components, pay workers, and build them in physical reality; it can’t just change some numbers on a spreadsheet and announce a million new Chevy Malibus. Stuff of actual, usable value can’t be magicked into existence, but money can.

That mystery has been highlighted during the pandemic, when the government kept the economy going by giving people dollars, which it mostly borrowed from the Federal Reserve, which conjured those dollars out of nothing. But the food and whatnot people bought with that money couldn’t be conjured out of nothing, so common sense tells us there’s a piper to be paid somewhere. In response, the smartest economists in the world say, “Well, yeah. Maybe eventually.” (If they sound more like priests of the Money goddess than practitioners of a hard science, that makes historical sense: The word money derives from an aspect of the queen of the Roman gods. Roman money could only be coined in the Temple of Juno Moneta.)

Libertarians are quick to tell you that such government-conjured “fiat money” is all a bubble that will pop someday: Real money is gold, and any paper money not redeemable for gold is a sham. But gold is mysterious in its own way. We dig gold out of the ground, smelt it into purified ingots, and then bury those ingots again in bank vaults. Somehow this strange digging-up-and-reburying process is supposed to be the basis of the world economy.

I mean, gold actually does have a few uses in jewelry-making and dentistry and electronics. But every year the world produces about twice as much gold as it uses for any practical purpose, so there’s little prospect that we’ll need our vast accumulated hoards of gold anytime soon.

Alchemists used to dream of transmuting more common metals into gold, which, if you think about it, would be exactly like the Fed conjuring dollars. The quantity of usable goods in the world would not change at all, so how would this new gold represent new wealth? A similar precious-metal illusion is sometimes mentioned as a cause of the fall of the Spanish Empire. Spain’s economy came to revolve around extracting gold and silver from the New World, while England was leading the Industrial Revolution. So Spain acquired the appearance of wealth, while England built a modern economy.

Anyway, the purpose of this long preamble is to make sure you have the right context for thinking about Bitcoin. If you only know two things about Bitcoin, this is what you should know:

- There is absolutely no reason why a bitcoin should be worth anything.

- It shares that characteristic with all other forms of money.

The history of Bitcoin emphasizes both the potential and the insubstantiality of its value. Wired says that the first recorded Bitcoin transaction happened in 2009, when someone traded 10,000 bitcoins for two Papa John’s pizzas. Bitcoins peaked at over $64,000 each in April, and crashed down below $40,000 on Wednesday. But in spite of the crash, whoever sold the pizzas is still doing pretty well.

What a cryptocurrency does. Understanding what a bitcoin is involves you in all kinds of complicated cryptological mathematics, and is mostly unnecessary. (It’s like computers: You don’t have to know how they work to use one confidently.) As Paul Krugman put it Friday, “Money is a role, not a thing.” So we should start by thinking about what Bitcoin does rather than what it is.

In general, a currency is a means of exchange, and its purpose is to facilitate trade, so that you aren’t constantly negotiating how many chickens to give the dentist for Jennifer’s braces. Traditionally, currencies have involved some kind of physical token, like a coin or a bill. You spend the currency by giving someone the token, which allows them to spend it somewhere else. (That description itself represents a change that has happened in my lifetime. Decades ago, people would have said that the coin or bill is money. Now we realize that it’s a token representing money, which is inherently intangible.)

These days, most transactions are done digitally, through credit cards or interbank transfers. This allows you to order stuff from Taiwan without shipping coins or bills around the world. So I might buy an app from a game designer in Bangalore or a song from a K-pop band in Seoul without any tangible objects moving in either direction. That makes the transaction faster, cheaper, and more reliable.

This system works because there are parties we all trust who can vouch for us. The game designer has no reason to trust me, but he trusts Visa, which trusts me. Ultimately, stuff like Visa and PayPal and Venmo work because banks trust other banks, all the way up to the central repository of trust, the Federal Reserve.

The point of a cryptocurrency is to get the advantages of digital transactions, but to avoid trusting the Fed, some equivalent government entity like the Bank of Japan, or a giant corporation like Citibank or Apple. Corporations shouldn’t be trusted because they don’t even pretend to have a purpose higher than profit, and a government might have all kinds of reasons to debase its currency — arguably, the US has been doing that with these recent trillion-dollar deficits — so why not create a system that isn’t subject to such temptations?

Also, the Fed (or whoever) can keep track of transactions that go through its systems, which you might not like because you’re a drug dealer or a tax evader or just somebody who puts a high value on privacy. (Right now, Matt Gaetz is probably wishing he hadn’t used Venmo.) Central-bank-based digital transactions may be fast, cheap, and reliable, but you have to give up the anonymity of cash.

So that’s the hole a cryptocurrency is trying to fill: fast, cheap, and reliable transactions that are as anonymous as cash, and denominated in a medium not vulnerable to political debasement.

Disintegrating the Fed. Essentially, the banking system that centers on the Fed is a big ledger that keeps track of how much money each person has; dollars are just the units it uses. When I pay my electric bill (whether by check or electronically), I send a message to deduct dollars from my account and add them to the electric company’s. If we use the same bank, that bank changes the numbers on its ledger. If not, ultimately the Fed changes its ledger to deduct dollars from my bank and add them to the electric company’s bank; the two banks then figure it out from there.

Again, this involves trust. We all just assume that the ledger will be kept accurately. If the ledger couldn’t be trusted, we’d soon be back to exchanging physical tokens, or maybe even swapping chickens.

Similarly, Bitcoin has to function like a big ledger that keeps track of how many bitcoins people have. If I’m going to buy something with Bitcoin, the system has to verify

- that I own the bitcoins I’m trying to spend

- that after the transaction, I have fewer bitcoins and the seller I bought from has more.

Further, I need to have confidence that if I don’t spend my bitcoins, I will continue to own them. Also, that the system won’t suddenly create massive numbers of new bitcoins in other people’s accounts, which could flood the market and lower the value of my bitcoins.

Now, if that ledger were just a file somewhere, like a spreadsheet, it wouldn’t offer either of the advantages a cryptocurrency is supposed to provide: We’d still have to trust somebody to maintain and update the spreadsheet, and investigators could subpoena it to see what we’ve been buying and selling. So why not just let the Fed keep doing that?

Instead, the list of Bitcoin transactions is encrypted and public. You could download the data yourself, but you couldn’t make sense out of it. The list of transactions is constantly being updated and verified by thousands of independent “miners”, who earn bitcoins for their effort. Any one of them could try to insert a fake transaction, but the others would catch the discrepancy. So we’re not trusting them as individuals, we’re trusting the collective entity they form.

Advanced mathematics gets into the picture to guarantee anonymity. The algorithms that define the Bitcoin system are constructed in such a way that even the miners who verify the list of transactions don’t know what they mean. (A more complete — but still not really complete — explanation is at Investopedia.) The important thing is

- With your key — like a password — you can prove that you own a bitcoin you want to spend.

- Without your key, no one can generate a “balance” that says how many bitcoins you own.

The situation is summed up by a rhyme Neal Stephenson put into his futuristic fairy tale The Diamond Age in 1995.

Castles, gardens, gold, and jewels

contentment signify for fools

like Princess Nell. But those

who cultivate their wit,

like King Coyote and his crows,

compile their power bit by bit,

and hide it places no one knows.

What’s a bitcoin worth really? The reason the value of Bitcoin can fluctuate so much is precisely the fact that it’s untethered from physical reality. Other kinds of money are too, but there’s a difference: None of them were ever really new.

Think about it. Trading in precious metals evolved “naturally”. There was never a moment when some chieftain or pharaoh announced for the first time “OK, from now on, gold is going to be our means of exchange”.

Coins derived their value from the metals they were made of. Originally, a coin was just a standard unit of metal whose purity and weight was validated by the government that minted it. So when King Croessus minted his gold coins 2600 years ago, he didn’t have to tell people what they were worth; they were worth whatever that amount of gold was worth. If you didn’t believe that, you could melt it down.

Paper money piggybacked onto the coin system. A bank note signified that some bank had precious-metal coins in its vault, and they’d give them to you if you turned the note in. So (as long as everybody believed that promise) nobody had to answer the question “What’s a ten-pound note worth?”

By the time paper money stopped being redeemable for gold or silver — 90 years ago for the British pound — its value had a long tradition behind it. So while the currency of a stable government might inflate or deflate a few percent each year, it won’t swing up and down week by week the way Bitcoin does. (When I was growing up, before the inflation of the 1970s, the way to say that a person was financially sensible was that he or she “knows the value of a dollar.” Today, somebody who truly knew the value of a bitcoin would be a savant.)

Digital dollars, euros, and yen are still convertible to paper currency. That’s what ATMs do.

So the units in the Fed’s database (i.e., dollars) may be just as theoretically meaningless as Bitcoin, but they have continuity of value that stretches back into prehistory.

Bitcoin doesn’t. That’s why 10,000 bitcoins might buy two pizzas, or a 600-foot luxury yacht, depending on what people happen to think that day.

What caused this week’s crash? Anything that booms is likely to bust at some point, so the search for a “cause” never has a clear answer. But one precipitating event was that Tesla announced it will no longer trade cars for bitcoins. This disrupted the story behind Bitcoin in two ways:

- According to its boosters, Bitcoin is supposed to become more and more accepted with time, until it becomes the premier means of exchange.

- The reason Elon Musk gave for Tesla’s decision: Bitcoin mining soaks up a lot of electric power, much of which comes from fossil fuels, including coal. If Tesla is promoting Bitcoin, it’s undoing the positive environmental effect of its cars.

Krugman comments on the first point:

And nowadays we use Bitcoin to buy houses and cars, pay our bills, make business investments, and more.

Oh, wait. We don’t do any of those things. Twelve years on, cryptocurrencies play almost no role in normal economic activity. Almost the only time we hear about them being used as a means of payment — as opposed to speculative trading — is in association with illegal activity, like money laundering or the Bitcoin ransom Colonial Pipeline paid to hackers who shut it down.

He goes on to point out that 12 years is a long time in tech: Bitcoin is the same age as Venmo, and older than the iPad or Zoom. The fact that it hasn’t caught on yet is a really bad sign.

One reason for that failure to catch on is habit, and the fact that most people are not nearly so desperate to get out of “fiat currencies” as Libertarians think they should be. (That might change if the current burst of inflation turns into more than the temporary blip economists like Krugman are predicting.) But a second good reason is the fluctuation in the dollar-value of Bitcoin itself.

Imagine, for example, that you’re a contractor negotiating a deal to spend the next two years building a bridge. You’d be crazy to take your payment in Bitcoin, because no one has any idea what Bitcoin will be worth in two years. Similarly, imagine if you’d taken out a mortgage in Bitcoin at the beginning of 2020, when a bitcoin was worth about $10,000. By this April, you’d have owed six times as much (in dollar terms). If your salary were denominated in Bitcoin, you’d have taken a 30% pay cut Wednesday.

The only way this makes sense is if you are living in a complete Bitcoin system, where you can pay your workers (or your rent) in the same currency that you’re earning, so that your income and expenses rise and fall together. Otherwise you’re gambling, not participating in a productive economy.

Now, it’s not unusual for new technology to face this kind of chicken-and-egg problem. (It made little sense to be an early adopter of the telephone, for example, because there were so few people you could call.) Tech that succeeds is compelling enough to overcome that problem.

But Bitcoin doesn’t seem to be that compelling. Maybe you weren’t planning to buy a Tesla with your bitcoins anyway. The fact that you can’t, though, is symbolic.

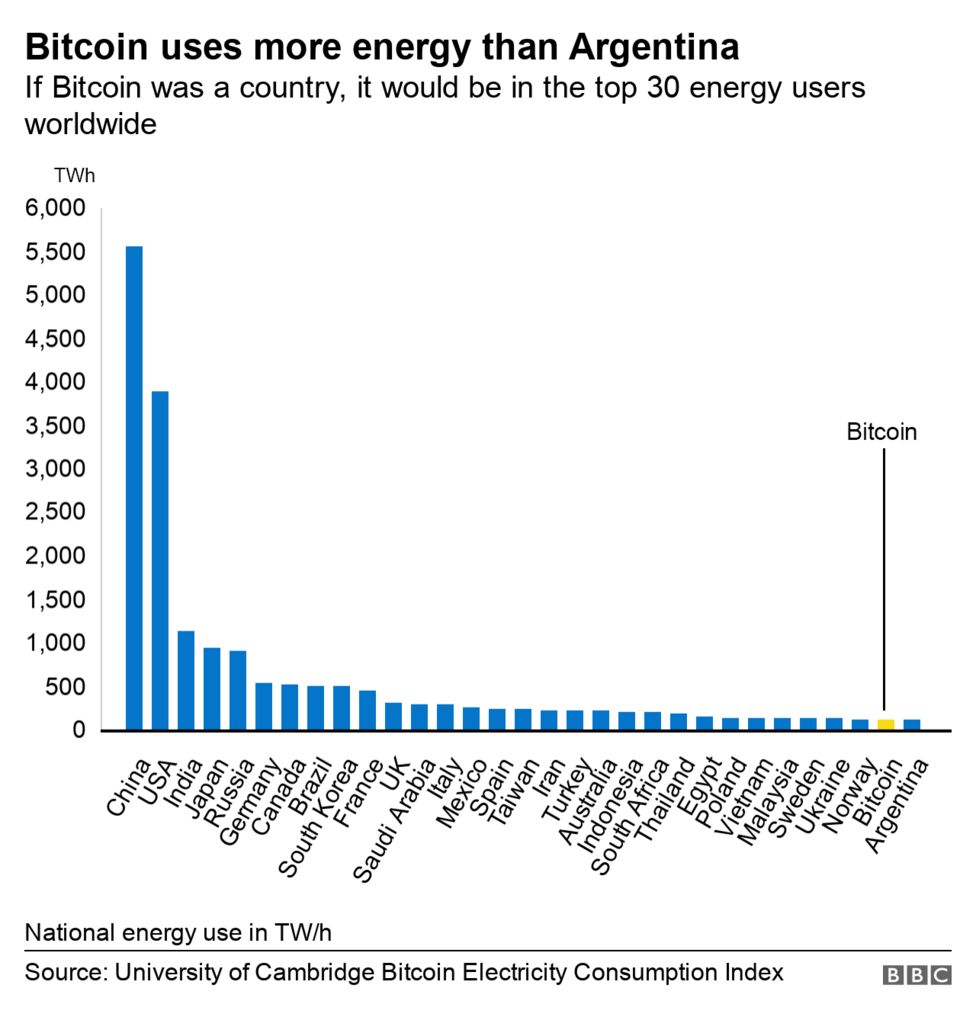

Bitcoin and global warming. The deeper problem is that Bitcoin mining eats up an enormous amount of computer power, which in turns eats up an enormous amount of electrical power. The Guardian reports:

Cambridge’s Centre for Alternative Finances estimates that bitcoin’s annualised electricity consumption hovers just above 115 terawatt-hours (TWh) while Digiconomist’s closely tracked index puts it closer to 80 TWh.

A single transaction of bitcoin has the same carbon footprint as 680,000 Visa transactions or 51,210 hours of watching YouTube, according to the site.

The same Centre for Alternative Finances claims that Bitcoin uses more energy than many countries.

That problem is likely to get worse, because the system is designed to require more computer power with time.

As more people learn about bitcoin and mining—and as the price of bitcoin increases—more are using their computers to mine bitcoins. As more people join the network and try to solve these math puzzles, you might expect each puzzle to be solved sooner, but bitcoin is not designed that way.

The software that mines bitcoin is designed so that it always will take 10 minutes for everyone on the network to solve the puzzle. It does that by scaling the difficulty of the puzzle, depending on how many people are trying to solve it.

Of course, the carbon footprint depends on how the electricity is being generated. And that brings up a different problem: No one knows exactly where the mining computers are, or how their electricity is generated. And because there is no central authority controlling Bitcoin — that’s part of the point, after all — no one can enforce environmental standards on the miners.

It seems likely, though, that miners are setting up in places where electricity is cheap. And at the moment, that is likely to be where it’s easy to burn coal.

Now, you could imagine setting up Bitcoin-mining supercomputers on the vast plains of Oklahoma, and powering them with fields of windmills. But even that plan is environmentally questionable. The growth in sustainable energy is supposed to replace fossil-fuel energy, not power some new need that didn’t exist 12 years ago.

Fatal wounds? For what it’s worth — notice that I’m putting it out for free — I think the environmental problem is a fatal wound for Bitcoin. Maybe in a not-too-distant future, computation requires much less electricity, which is generated by solar arrays in orbit, so nobody cares about the computational burden of their digital currencies. But maybe not.

In the meantime, we’re not there.

Right now, for Bitcoin to catch on and rival the dollar, the yen, and the euro, it needs the kind of early-adopter enthusiasm that comes from people believing that they’re doing something cool. Twelve years ago, those two Bitcoin-purchased Papa Johns were the coolest pizzas in the world.

Now they’re not, and even Elon Musk realizes it. Maybe at some point, your friends would have been awed if you’d said, “Like my new Tesla? I bought it with Bitcoin.”

But with every day that goes by, you’re less and less likely to get that reaction, and more and more likely to convince people that you’re willing to destroy the planet for your own vanity. “Oh, you’re that kind of asshole.” (At the moment, the world’s most famous Bitcoin miner is Joel Greenberg. That kind of asshole.)

That’s fatal. Maybe not today or tomorrow, but soon.

This all says nothing about the underlying argument for some kind of cryptocurrency. Maybe trillion-dollar deficits really are evidence that the world’s governments and central banks can’t be trusted to maintain our money. Maybe there is room in the world for — or even a need for — a crowd-sourced money based on cryptographic algorithms.

But that currency is going to need a high level of coolness to beat the chicken-and-egg problem and catch on. And eating up a nation-sized chunk of the world’s energy output is not cool.

Comments

Thank you so much for explaining about the “mining bitcoin” problem. I was very confused about how you can mine a digital currency.

The mining situation could be fixed if Bitcoin goes from a “Proof of Work” (the current system) to a “Proof of Stake” system. Which is already used by many other crypto coins. The downside is that it is a less “democratic” way of distributing new coins, as they only go to current holders – but then, computer and energy investment necessary to receive payouts in the present regime is beyond most people already – as opposed to the early days of Bitcoin where kids in college dorms were a major source of miners.

Of course, digital currency will have the smallest environmental impact. But I’d be curious to know how Bitcoin compares to the environmental cost of printing paper money. I would expect coins to have the greatest cost, although their long life will mitigate that somewhat. Also, coins allow for seignorage, where the government that mints them can credit itself with the value of the metal used (this of course doesn’t apply to paper or electronic currency, or cryptocurrency).

The point about volatility is exactly right. Imagine you talked about buying a car from me for 0.5 bitcoins, worth $32,000 a week ago. Then today we got together to exactly exchange the car for the bitcoins, would you still pay 0.5 bitcoins (now $20,000) or would you still pay $32,000 (now 0.8 bitcoins)? A moment’s thought says the latter is far more sensible, which means bitcoin is not a currency, it’s a slow, unwieldy payment technology, basically just an ineffective Venmo.

Also minor point on GW Jr’s comment: Any currency allows seigniorage – coins are actually the worst because they’re expensive to make, whereas paper or electronic currency is nearly free to create. If a government creates new money, the total value of all money (existing + the newly created) shouldn’t be lower than the value of existing money before the new money was created, meaning that the government has earned some revenue, likely by decreasing the value of the public’s money holdings.

In light of the energy cost of Bitcoin, it’s interesting to consider what a carbon tax would do to the economics of Bitcoin mining.

“So that’s the hole a cryptocurrency is trying to fill: fast, cheap, and reliable transactions that are as anonymous as cash, and denominated in a medium not vulnerable to political debasement.”

And Bitcoin isn’t catching on because almost no one sees that as a hole that needs filling.

And unlike cash, you need some kind of electronic device to use Bitcoin, which adds a barrier to entry that makes it out of reach for the poorest of the poor.

That and bitcoin transactions aren’t actually fast

Anyone with a phone can receive or sell it. People send it to their relatives in India, Africa…

“Anyone with a phone can receive or sell it.”

So it’s basically like regular money on PayPal, Venmo, or CashApp, with the disadvantage that it has to be converted into regular money if the recipient wants to use it for most purchases.

The real problem is that Bitcoin is not a fiat currency. Just who would want to be a Greece, forced to suffer crippling unemployment simply for want of money? No one, apart from the cash-rich who fear debasement. Real strength in an economy comes from people working, not sitting idle. Summoning money ex nihilo to encourage idle hands to pick fruit that would otherwise spoil makes us ALL richer.

Cryptocurrency’s true believers are pining for a feudal fairyland where they need not heed the government, and where the poor jump at their command, grateful for any chance to rub two satoshi together. The unimaginable productive power of the modern world stands as a stark rebuke to their fantasies.

Money doesn’t make sense? Sure it does. Money is a promissory note. That’s it. If you understand promises, you understand money.

If you have a trading partner that you don’t trust, you are forced into a barter situation because you can’t trust your partner’s promise. If you use an intermediate commodity such as gold as a medium of exchange, it’s still barter.

If you do trust your trading partner, you might be willing to accept a promissory note from them, and in theory you could pass that note on in payment of your own debts. In practice, of course, the usability of that note would be limited to the extent of trust in the issuer of the note.

Ultimately, if there’s a third party that is widely trusted, say a government or a bank, you can use their promissory notes as money. And that is what all modern economies do. When you accept money, you are accepting some trusted agent’s promise of a future benefit that is worth a specified number of dollars. The stuff we normally call money is how we keep track of these promises. We use paper and little pieces of gold or other metal stamped just so. Today, we most often just use computers to keep track of financial promises (most money is just spreadsheet entries).

The Government used to promise that you could either exchange its money for gold or you could pay your taxes with it. Now it only promises you can use it for tax payments. Banks for their part issue financial promises in the forms of deposits and checks and so on. A deposit is not a pile of dollars in a vault somewhere with your name on it, it is a promissory note from the bank payable in Government dollars.

When the Government wants to hire someone or buy something, it gins up some spreadsheet entries it calls dollars out of thin air and offers them to the private sector (us) as payment for goods and services that we create out of thin air. It motivates us to accept the dollars by requiring us to pay taxes with those dollars. The dollars circulate in the private sector, facilitating economic transactions in the private economy until they are returned to the Treasury as tax payments where they are just cancelled, having served their intended purposes.

Bitcoin is not a promissory note, it is a virtual commodity. Its value depends only on perception, not promise.

I should add that this reality is obscured by the fact that lots of government spending is financed by Treasury bonds, which are…promissory notes created by the government out of thin air and payable with government dollars created out of thin air.

> Stuff of actual, usable value can’t be magicked into existence, but money can.

Strange, because I think that’s what you just did with this article, just as software companies do, just as Netflix does.

I read that same line by Krugman: Money is a role, not a thing. I’d say that money is a certain kind of thing that can play the role of money. Grains of sand can’t play that role, nor could the Mona Lisa. A certain level of scarcity, real of artificial, is necessary.

Even if energy were free, the world would still have an environmental problem with Bitcoin. People mine because it is lucrative. The more the price of Bitcoin appreciates, the more lucrative mining becomes, and so the more people pour into it. Energy costs are one factor in determining profit, but so is hardware. Remove the energy costs, and people would simply buy more hardware. The environmental costs would increase until the entire endeavor ceased to make financial sense for the miners.

This is exactly what happened recently with Chia coin. Meant to be the “environmentally friendly” currency, it required no serious computations, just hard drive space. It was advertised as something people could mine with old spare hard drives, but the power of speculation and self interest had everyone buying new hard drives, *lots* of them, creating or exacerbating a hard drive shortage.

I should add this: after having no belief whatsoever in cryptocurrencies, ever, I decided to try Chia on a whim, to see if I would feel good about boosting the environmentally friendly option. When I bought one hard drive, I thought, “this is a bad sign”. When the next few people after me bought ten or one hundred hard drives each, I thought, “ohhhh. nope, this won’t be good”, and stopped.

Miners are gravitating, and will keep gravitating, to cheap energy. That only makes sense. Some are using hydroelectric power. A big mining set up in Iceland uses geothermal energy, which is limitless. Just because they have been using coal doesn’t mean they will keep doing so. That was just the cheapest option wherever they are. Also Bitcoin is a store of value. It doesn’t matter if you can’t buy much with it. (Although Home Depot and other retailers do accept payment in Bitcoin, even though Musk changed his mind.) You can turn Bitcoin into dollars or whatever national currency you need to do that. Meanwhile, it’s an international currency, with all the benefits of that. Companies can make trusted, quick transactions with it, without all the government red tape, because they can see the money sent immediately on the balance sheet. There are other advantages, but I’ll stop there.

Except China just outlawed it for private use. As soon as it begins to threaten the official government-controlled monetary system (assuming it ever does), rest assured that other governments will follow suit. Cryptocurrency will be worthless if you have no way to spend it on anything.

They are also asking people to report suspected miners, so it’s not just the use that is outlawed

Doesn’t matter if China doesn’t like it.

But it will matter if more countries outlaw it. All China has to do is require any countries that it trades with to outlaw crypto, and it will be worthless overnight.

One of the first rules of investing is to never invest in anything you don’t understand. After reading several articles (including sift today) I still don’t get it. I am older therefore somewhat out of it but after earning an MBA (Mediocre But Arrogant) and years of successful investing I’m not able to apprehend how something of material value can be “mined” in cyberspace. Reasonably sure I don’t want to make the effort.

I’m would like to understand Libertarian thinking as exposed by a relative with whom I no longer able to discuss politics or much of anything else. He says we should go back on the gold standard since the “full faith and credit” of the government is meaningless yet he is a fan of cryptocurrency for which I find no tangible backing. Lot of talk of getting the government out of money, inflation, and the “elites” controlling the money supply.

I’m always amused by calls to return to the gold standard, as if that would improve anything. As a commodity, tying currency to gold would make it far more volatile. Also, there isn’t enough gold in the world to run the economy today. The government would have to confiscate all gold in private hands (including jewelry) and declare the price to be several million dollars an ounce.

In the case of your libertarian uncle, the “full faith and credit” of the government means he goes to jail if he doesn’t pay the government what the government claims he owes in taxes. It doesn’t get much more meaningful than that. Basically, calls to go back to a gold standard are calls to go back to a barter economy, since using gold or any other scarce commodity of intrinsic value as a medium of exchange is just a more sophisticated form of barter.

Thank you so much for providing some user-friendly, non-weasly information about Bitcoin and how it works. Several years ago a family friend tried to get me to invest in Bitcoin. After nearly an hour of increasingly convoluted jargon and shop talk, I gave up, more confused about what it was than when I started. And if others have had that experience, that may be another reason it hasn’t caught on. If it walks like a scam and quacks like a scam…

Bitcoin also has money supply problems.

A currency is “valuable” in the role of being money by having stable prices. Stable prices require the ability to modify the quantity of currency in circulation commensurate with the level of economic activity* so any currency that has a fixed quantity or fixed rate of change in the currency will naturally have an equilibrium that has one stable solution and one unstable solution. The unstable solution is infinity. And the stable solution is zero.

I don’t know how long Bitcoin and other coins will remain on the path to infinite prices. But I do know it will end eventually.

*the end of inflation in the 70s coincided with advancements in understanding how the fed could effectively control the quantity of the currency and then the will to execute those techniques.

This. Bitcoin, like gold, has money supply problems. Barter systems in general have money supply problems.

Elon really should have known better. There was a cringeworthy brofest between him and Jack Dorsey on Twitter (where else?) that led to Jack actually linking to a whitepaper by one of his companies actually claiming Bitcoin mining is part of the solution because it will encourage investment in solar power capacity!

Some crypto enthusiast at work actually cited that as a reason that bitcoins are actually good for the environment. Yes, some tech bros really are that kind of assholes

A key point is that it isn’t simply history and expectations that keep the value of the dollar predictable, it is that the federal reserve’s actions regarding the money supply are following a policy with the primary objective of keeping the value of a dollar predictable. You can think of a dollar as backed by the basket of goods that the federal reserve uses to measure core inflation. Sort of. But the exchange rate varies over time, but at a smooth, predictable rate according to the Fed’s inflation target. Approximately. Assuming they are competently managed.

Where history comes in is that if people expect a stable dollar over the long term, that prevents short term panics/manias in anticipation of future value changes, as we often see with Bitcoin. Which in turn makes the Fed’s job easier. So this is in my mind a big thing that gold bugs/the creators of most cryptocurrencies get wrong: Stability of the value of money does not and will not naturally follow from the stability of the quantity of money. Money is by default unstable and prone to panics/manias, and its value needs to be actively stabilized. Libertarians make the mistake of viewing the Fed’s interventions as arbitrary decisions that are an additional source of variability on top of anything else causing fluctuations in the value of money (which it could be if poorly managed) rather than intentional policy driven actions to compensate for fluctuations.

Trackbacks

[…] This week’s featured post is “The Problem With Bitcoin“. […]

[…] Problem With https://weeklysift.com/2021/05/24/the-problem-with-bitcoin/ […]