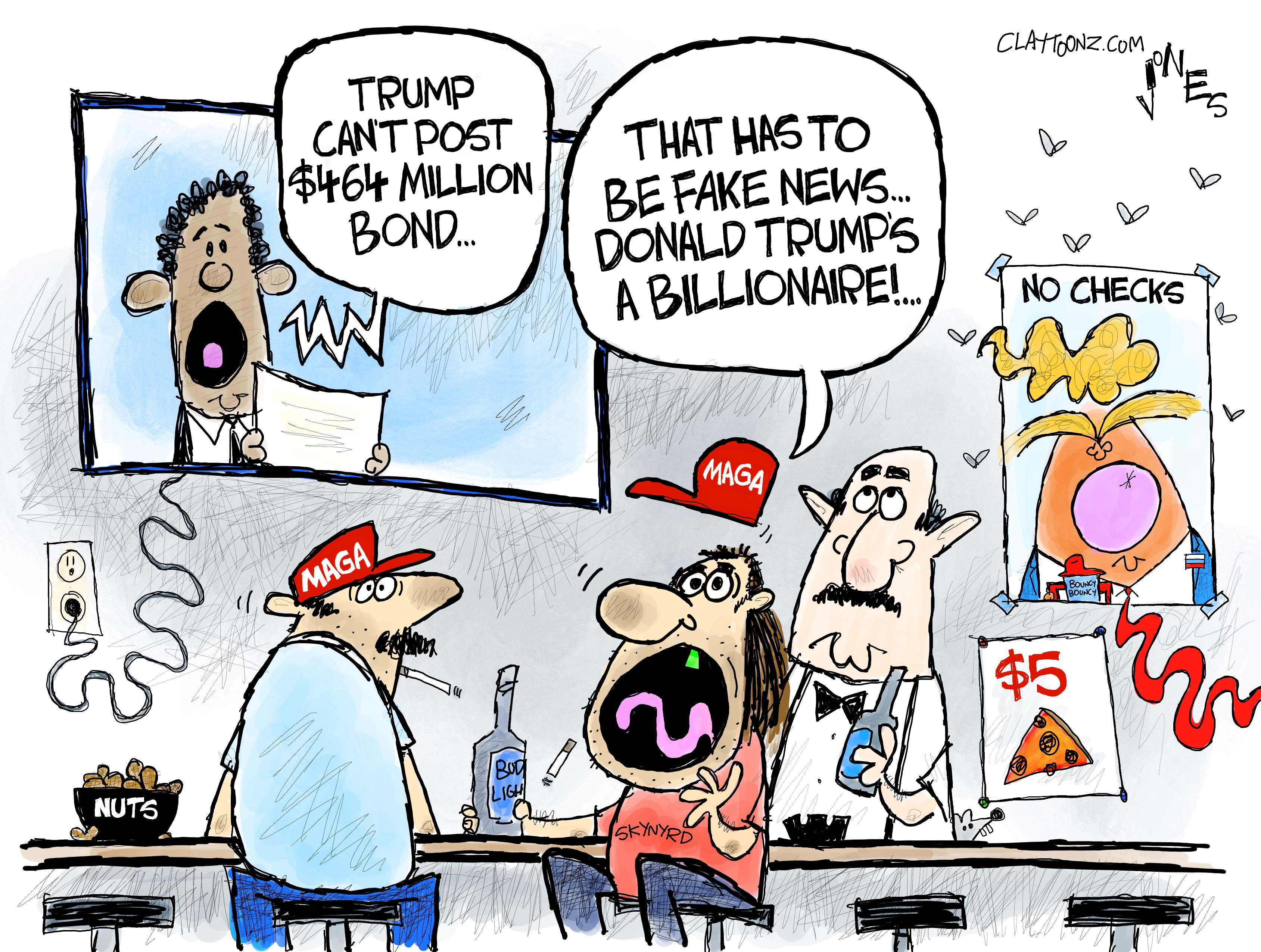

Today we’ll find out whether Trump can raise half a billion dollars.

Today is the deadline for Trump paying an appeal bond that would put his $464 million civil fraud judgment on hold while his appeal plays out. All week news outlets have been speculating about what might happen.

Trump’s lawyers have claimed that posting the bond is “a practical impossibility” because they’ve been turned down by 30 bonding companies. Trump himself then contradicted his lawyers by claiming on Truth Social that he does have the money (more about that below), but that the judgment was “rigged and corrupt”, as if saying that absolves him from paying what he owes. All Trump spokespeople claim that he’s worth far more than the bond, but that he’s having trouble raising the money because his assets are mostly in illiquid real estate that bonding companies don’t want to take as collateral.

That explanation doesn’t make a lot of sense, for a number of reasons. First, while bonding companies may not like to hold real estate, banks make real-estate loans all the time. So if he’s really worth the money, he should be able to get a bank loan that he can either use to pay the money himself, or to show to a bonding company as evidence that he can pay it.

Trump’s lawyers also cited the time it would take to raise this much money. They were writing a week before the bond was due, which does sound like a tight timeline. But NY Attorney General James filed the lawsuit almost a year and a half ago. Judge Engoron issued a summary judgment against Trump in September, and the recent trial was just to determine the penalty.

So Trump has had plenty of time to make a what-if-I-lose plan. If he didn’t, that isn’t anybody else’s problem now.

I only see two explanations that make sense:

- Trump can raise the money, and his lawyers were lying to the court. Maybe this was a negotiating tactic to pressure the appeals court to lower the bond. Or maybe he wanted an impending crisis to fund-raise with. Or maybe he actually wants Tish James to start seizing his properties, because that would underline his claims to the voters about how persecuted he is.

- Trump can’t raise the money, because he’s not worth that much. Everyone agrees that the assets of the Trump Organization are worth considerably more than what the court demands. But we don’t know how much he has already borrowed against those properties, so there may not be much equity left. The Trump Organization claims its properties are “among the most valuable and prized office towers anywhere in the world“, but the value of such buildings has plummeted post-Covid. Maybe he can’t get a half-billion-dollar loan on them because the numbers just don’t add up.

One possible deus ex machina in this situation is that Truth Social is about to go public. In theory, Trump’s shares in the company would be worth billions — possibly more than he has ever actually been worth. Currently, he’s not supposed to sell the shares or use them as collateral for six months. (That’s a fairly standard IPO lockup provision.) But the board, which Trump controls, could waive the lockup.

As Jay Kuo points out, though, there’s something hinky about this whole situation: Truth Social shouldn’t be worth much at all, and certainly not billions.

Truth Social is not a successful company, at least not yet. It had only about $5 million last year in revenue, and it had lost over $30 million through the third quarter of 2023. Its user base is paltry at just 8.9 million registered users, and it’s not very likely to grow into anything like the next Facebook or Twitter.

For comparison, X/Twitter has 335 million users and is estimated to be worth a little over $12 billion (after Musk paid over $40 billion for it).

Kuo classifies Truth Social (which will trade under the name Trump Media and the symbol DJT, Trump’s initials) as a “meme stock”, one that has few institutional investors, but is owned by individuals who hype it on social media. Such stocks typically collapse at some point. So the odds are low that Truth Social will be worth billions when Trump’s six-month lockup period runs out.

Truth Social is a speculative investment bubble that will reward those who can cash out at the high and punish those who are left holding the bag at the end. Trump is quite adept at this scam. He once sold NFT Trump “trading cards” to his base that went sky high before sales dropped 99 percent.

Ditto for Trump’s $399 gold sneakers.

In short, Trump Media is “the biggest grift of his life”. We’ll see if he pulls it off.

Trump’s lawyers talk as if nothing has been decided yet, because he can still appeal. But he lost the case. Losing in court actually means something, and courts require appeal bonds so that losers don’t abuse the appeal process just to delay paying.

The thing you have to keep in mind when Trump or his lawyers whine about the hardship of having to sell at “fire sale prices” is that paying your debts is often painful. Most Americans already understand that fact of life, and it shouldn’t change just because your name is Trump.

You have to love this Truth Social post by Trump. (I’ll spare you the all-caps.)

Through hard work, talent, and luck, I currently have almost five hundred million dollars in cash, a substantial amount of which I intended to use in my campaign for president. The often overturned political hack judge on the rigged and corrupt A. G. case, where I have done nothing wrong, knew this, wanted to take it away from me, and that’s where and why he came up with the shocking number which, coupled with his crazy interest demand, is approximately $454,000,000. I did nothing wrong except win an election in 2016 that I wasn’t expected to win, did even better in 2020, and now lead, by a lot, in 2024. This is communism in America!

The remarkable thing about this post is that almost every piece of it is false.

- He got rich by inheriting hundreds of millions from his Dad, possibly in violation of tax laws. That could be seen as a combination of luck and fraud, but not hard work or talent.

- Far from using his own money in his campaign, he’s been using campaign cash (mostly from his Save America PAC) to pay his personal legal bills. The idea of getting the RNC to pay his legal bills has also been floated. (See cartoon below.)

- As for whether Judge Engoron is “frequently overturned”, I’ll have to see some evidence of that. “Political hack”, “rigged”, and “corrupt” are standard Trump insults that he throws at anyone standing in his way.

- The size of the judgment against Trump is large, but doesn’t come out of thin air: It’s the difference between the interest rate he was offered without needing to make personal guarantees, and the interest rate he actually paid. Since the personal guarantees were backed up with fraudulent statements, the difference constitutes an ill-gotten gain which the state has demanded he disgorge. The total includes no punitive damages or anything else subjective.

- The “crazy” 9% interest rate he’s being charged is set by law, and would apply to anyone.

- What he did wrong was submit fraudulent financial statements.

- Due to the Electoral College, he did unexpectedly win an election in 2016, despite Hillary Clinton getting 2.9 million more votes. And while he did get more votes in 2020 than in 2016, he lost to Joe Biden by seven million votes, which is a strange definition of doing “even better”.

- He currently leads in some polls but not others, and never by “a lot”. The latest Economist polling average has Biden up by 1%.

- “Communism” is another meaningless Trump insult. His situation has nothing to do with public ownership of the means of production.

So what are the odds that ” I currently have almost five hundred million dollars in cash” is true?

Trump’s predicament has given Biden a biting joke to tell on the campaign trail.

Just the other day a defeated-looking man came up to me and said, “Mr. President, I have crushing debt, and I’m completely wiped out.” And I had to look at him and say, “Donald, I’m sorry. I can’t help you.”

Comments

I’m not sure if Trump can get loans backed by his real estate to pay his bond. most commercial loans and commercial lines of credit have general or specific uses listed and I would guess this is an issue. also many businesses were already leery of doing business with Trump and loaning money on his real estate for his bond may hold more risks in more types than anyone else wants.

I think the difficulties Trump is having paying the court is more of the same manipulation. By complaining about the difficulty he stays at the top of the news, giving him more opportunity to paint the decision as unfair, continue fundraising on the issue, etc., etc. As he’s often done before, when the actual deadline comes he’ll make the payment and move on, having gotten all the mileage he can out of a fake crisis.

The greatest con of his life is on for the scripted ‘reality’-tv star who plays a fictional character who happens to have the same name as his legal one.

Gullible MAGAts have driven the per-share price of the company created out of thin air to take Truth Social public up by almost 50%. Assuming the requirement that initial IPO investors can’t sell their stock within the first six months has been waived (and this is almost certainly a part of this scam), Trump stands to pocket in excess of $4B for a business that’s losing millions every month.

The share price of this stock will, of course, crater when the supply of rubes have been exhausted and the sharps have cashed out. This is what happens to almost every SPAC, which are one of Wall Street’s favorite scams these days.

If this doesn’t sum up the career of Donald J. Trump, the world can’t afford whatever would take its place.

P. T. Barnum was far too conservative in his analysis: there’s a sucker born every second, and you can find them under all those red hats wandering around.

Trackbacks

[…] week’s featured posts are “Is Donald Trump Still Rich?” and “What Republicans Want“. The two posts together are quite long, so […]